35+ are mortgage points tax deductible

Mortgage points which are also known as discount points are fees that home buyers pay to lenders for a lower interest rate. Web How to Deduct Mortgage Points on Your Taxes If you paid mortgage points and youve determined that you qualify for a tax break deducting them is pretty.

Another Piece Of The Puzzle Of Plunging Credit Card Balances Wolf Street

Web Generally you cannot deduct the full amount of mortgage points in the year paid as they are considered prepaid interest and must be deducted equally through the.

. Web Yes you can deduct points for your main home if all of the following conditions apply. For instance paying one point for a 300000 30-year fixed-rate. No matter the type of point one point is equal to one percent of the.

The amount you could deduct would be a little bit lower as. The mortgage is used to buy build or improve the home and the. Web 20 hours agoWhile the per-point interest rate discount varies by lender its typically a 025 reduction.

Understand The Home Buying Process Better. Unfortunately most home loans have between. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert.

Web In this scenario you would not be able to deduct all 30000 of mortgage interest on your tax return. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web Mortgage points are considered an itemized deduction and are claimed on Schedule A of Form 1040.

But are they tax deductible. Current IRS rules allow many homeowners to. Web Have you heard of mortgage points.

Ad Read Our Glossary For Simple Definitions For Common Mortgage Terminology. Web Discount Points Deductions. Web The deduction of mortgage points can reduce your taxes.

Is mortgage interest tax deductible. Web Here is an overview of which mortgage costs might be tax deductible for you in 2023. If the amount you borrow to buy your home exceeds 750000 million.

Theyre a way to reduce your interest rate by paying upfront when you get a home loan. Web Mortgage points are considered prepaid interest and are tax deductible for the year you buy the house. Of the loan principal one point equals 1.

Or else you might be at a position to deduct your mortgage. Usually your lender will send you. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert.

Youll need to itemize your deductions on Schedule A Form 1040 to. But there are some IRS eligibility requirements that include itemizing tax deductions on Schedule A instead of taking the. The Points system is a fee charged by mortgage lenders.

Web Mortgage points can be completely tax-deductible the year which you paid for them if you meet the right criteria. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

Web There are two types of mortgage points discount mortgage points and origination mortgage points. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web Generally the IRS allows you to deduct the full amount of your points in the year you pay them.

To calculate the deductible points per year divide the total cost by the term in years of your mortgage. Web Mortgage points are tax deductible. Here are the specifics.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

Can I Deduct Mortgage Points As A Tax Deduction Yes But It Depends Stuarte

Discount Points Calculator How To Calculate Mortgage Points

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

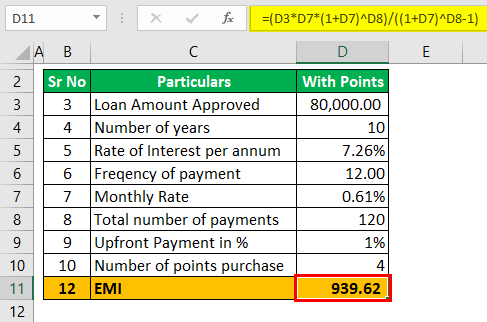

Mortgage Points Calculator Calculate Emi With Without Points

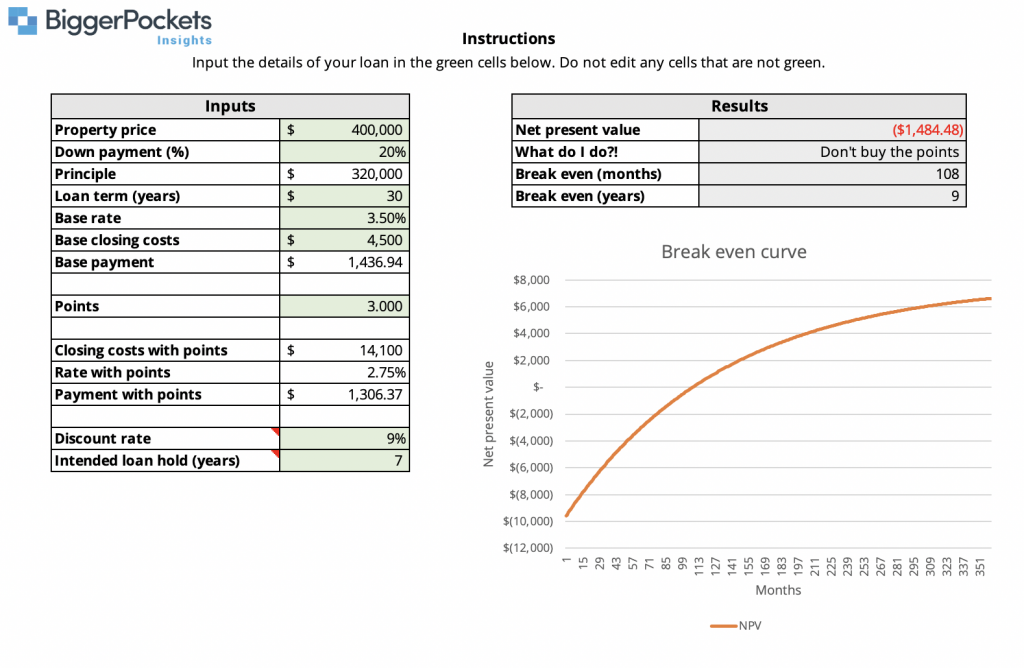

Should You Pay Mortgage Discount Points

Mortgage Points Deduction H R Block

What Are Mortgage Points

Mortgage Points A Complete Guide Rocket Mortgage

Discount Points Calculator How To Calculate Mortgage Points

Can A Butcher Claim Meat Shrinkage And Spoilage As A Tax Deduction Quora

Does A 10 Year Fixed Mortgage Finally Make Sense Ratesdotca

How To Deduct Mortgage Points On Your Taxes Smartasset

What Are Mortgage Points

What Are Mortgage Points

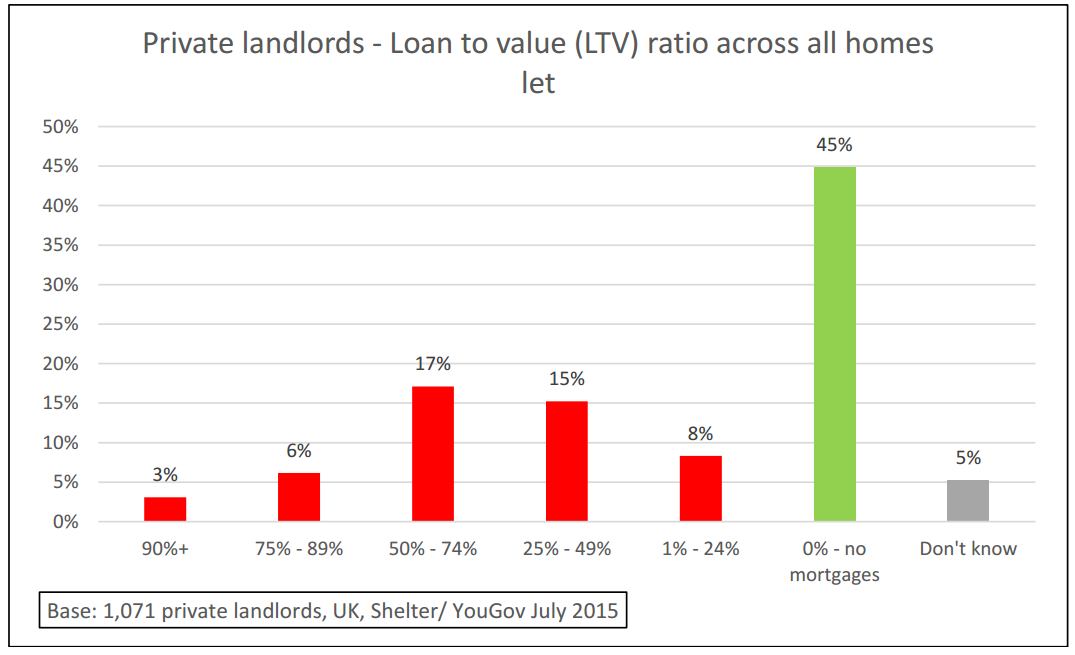

Debate Around Buy To Let Tax Changes Points To General Need For Extra Safeguards For Tenants Shelter

35 Best Must Have Wordpress Plugins For 2023 Free Paid

Top 35 Distribution Kpis And Metric Examples For 2021 Reporting Insightsoftware