epf dividend 2021

Most economists have anticipated 2021s dividend rate to be between 45 and 55 but the more optimistic have put it at 5-6. KUALA LUMPUR 8 June 2021.

Cu8judgkfkf8 M

17 hours agoReason to cheer.

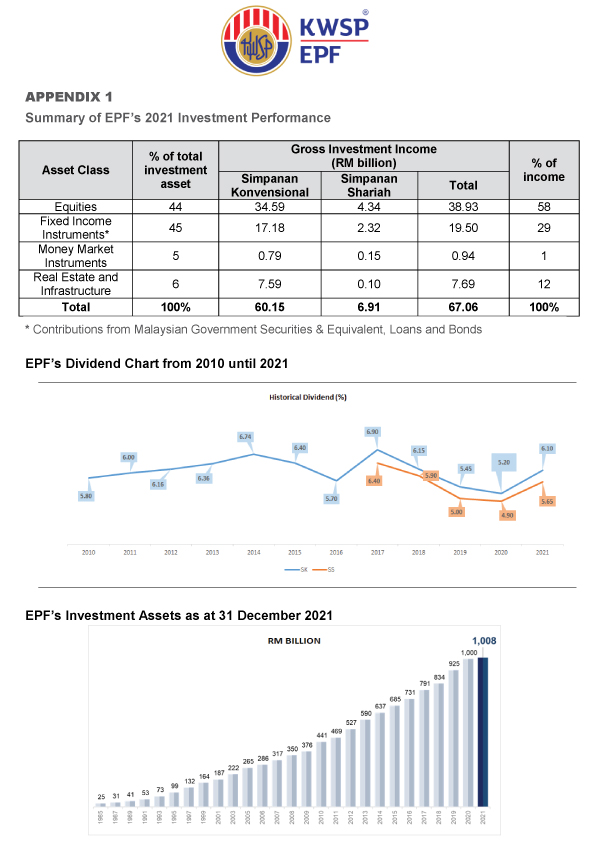

. To note EPF recorded a dividend of 52 and 49 for Conventional Savings and Shariah Savings for 2020 respectively. The EPFs total absolute dividend payout also looks set to reach a new all-time high in 2021 beating 2017s RM4813 billion even though the EPFs fund size may stay flat or slightly smaller year on year due to Covid-19-related withdrawals The Edges estimates show. In fact there is that chance that the conventional dividend may reach its highest in three years maybe even touching 6.

The dividend payout ratio for the EPF Boards conventional account last year was 520 while the payout ratio for the Islamic account was 490. Ad Search Ex-Dividend Dates Dividend Calendar All-Star Rankings More. THE Employees Provident Fund EPF is expected to pay a higher dividend for 2021 thanks to a well-diversified portfolio under its Strategic Asset Allocation and prudent measures despite the pandemicPutra Business School Assoc Prof Dr Ahmed Razman Abdul Latiff said EPFs equity asset class always recorded the highest investment income especially.

EPF RECORDS HEALTHY RETURNS OF RM1929 BILLION IN GROSS INVESTMENT INCOME FOR Q1 2021. Bernama pic February 27 2021. The bad news is that 48 of EPF members now have less.

The 1H2021 performance is significant given that the EPF paid out RM4764 billion in dividend in 2020 RM4288 billion for Conventional Savings and RM476 billion for Shariah Savings. HERE is a piece of news to consider amid misguided calls to allow more premature withdrawals from the Employees Provident Fund. Many people are concerned about how much the EPF will pay dividends.

KUALA LUMPUR The Employees Provident Fund EPF dividend for this year will depend on market performance the Covid-19 vaccine roll-out and global coronavirus immunity said CEO Tunku Alizakri Alias. 15 hours agoMalaysias Employees Provident Fund Kuala Lumpur credited a 61 dividend payout to the accounts of its more than 14 million participants for 2021 its highest rate in three years said Amir. This came following the provident funds announcement yesterday which indicated that it accrued a nine-month profit of RM4802 billion despite challenges such as massive Covid-19 withdrawals.

The EPF 2021 dividends are 61 for conventional savings and 565 for syariah savings. If indeed the amount to pay 1 of dividend to members for 2021 stays roughly unchanged at around the RM92 billion needed to pay 1 of dividend in 2020 as its. Dividends from the EPF for 2021 look set to top the rate in 2020 52 conventional 49 shariah.

KWSP announced a 520 dividend rate for 2020 the lowest since 2008 450 due to the pandemic. Najib also gave the similar opinion that the EPFs performance in 2021 was better. 1 day agoKUALA LUMPUR March 2 The Employees Provident Fund EPF has declared a 615 per cent dividend for conventional savings and 565 per cent dividend for Shariah savings in 2021 according to local business daily The Edge.

KUALA LUMPUR Feb 15. According to economists forecasts the payout rate is expected to range from 52 to 6 in 2021 due to higher total investment by the Employees Provident Fund Board EPF and better capital market performance as well as factors such as the upcoming general election. PNB yesterday announced a total distribution of five sen per unit for ASB unitholders comprising a 425 sen distribution and a 075 sen bonus for the financial year ending Dec 31 2021.

On whether EPF could produce similar results this year Amir said it was too early to. In 2020 it was 52 for conventional and 49 for shariah. The Employees Provident Fund EPF recorded a gross investment income of RM1929 billion for the first quarter ended 31 March 2021 despite the continued uncertainties from the ongoing COVID-19 pandemic.

The Employees Provident Fund EPF is expected to declare a handsome dividend payout for 2021 ranging between 52 per cent and 60 per cent on the back of the funds. THE Employees Provident Fund EPF is expected to pay a higher dividend than Permodalan Nasional Bhds Amanah Saham Bumiputera ASB. The Edge had in mid-January estimated that the EPFs dividend rate would be above 2019s 545 and could even exceed 6 for 2021 based on the funds performance in the first nine months of 2021.

According to the investment performance report for the first 9 months of last year just released by the Employees Provident Fund Board investment income for the period ending September 30 2021. EPF has declared a dividend of 52 for conventional savings and 49 for shariah savings for 2020. There is even a chance of conventional dividends reaching their highest in three years above 2019s 545 possibly even touching.

More economists have stepped forth to declare their optimism in the Employees Provident Funds EPF capability to deliver good dividends for 2021. In a news report published online this afternoon the daily reported that the total payout for the year was RM571 billion. 23 hours agoThe dividend payout for 2021 shows that EPF is well on the road to recovery from the dire economic situation brought about by the pandemic as this is the highest dividend payout declared for conventional savings since 2018 where the dividend payout was 615.

It will pay out a total of RM5672 billion for 2021 with RM5045 billion for conventional savings and RM627 billion for shariah savings. It is driven by the increment of gross investment income besides a positive capital market performance. I expect the EPF dividends for 2021 will probably be around 52 for Conventional Savings and 49 to 52 for Shariah Savings making it consecutive years that its dividends will be higher than PNBs said Dr Ahmed Razman.

Earlier several economists projected that the EPF will announce a more interesting dividend for 2021 between 52 to six percent.

Epf Announces 5 2 Dividend For Conventional Accounts 4 9 For Shariah Free Malaysia Today Fmt In 2021 Dividend Accounting Financial Planner

10 Sept 2019 10 Things Dividend Senate

27 Sept 2020 Investing Bar Chart Dividend

Epf Declares 6 1pc Dividend For 2021 All Time High Payout Of Rm57 1b

New Tax Regime Tax Slabs Income Tax Income Tax

Qrl89hc9fb43xm

Ce4anvaqjbb7um

Atwfxk5kjzgeem

Ct96ldpd3aapsm

Got Inflation Blues Consider Dividend Stocks Wharton S Siegel Thestreet In 2022 Dividend Stocks Dividend Dow Jones Index

Epf S 1h Performance Points To Higher 2021 Dividend The Edge Markets

1 June 2020 The Unit Words Word Search Puzzle

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Budgeting Personal Finance Tax

Economist Calls For Complete Overhaul Of Epf Pension System Free Malaysia Today Pensions Finance Pension Fund

Q2twv7veyoubem